Breaking Down Josh Conner Net Worth and His Achievements

Josh Conner has built a successful career in the finance world, earning recognition for his expertise in investment banking and private equity. With years of experience in major financial institutions and leadership roles in investment firms, he has established himself as a key player in the industry.

Given his professional achievements, many are curious about Josh Conner’s net worth and how his career has contributed to his financial success. Whether through banking, private equity, or board memberships, his income sources reflect the rewards of a high-level financial career, making him a noteworthy figure in the world of finance and investments.

Who is Josh Connor?

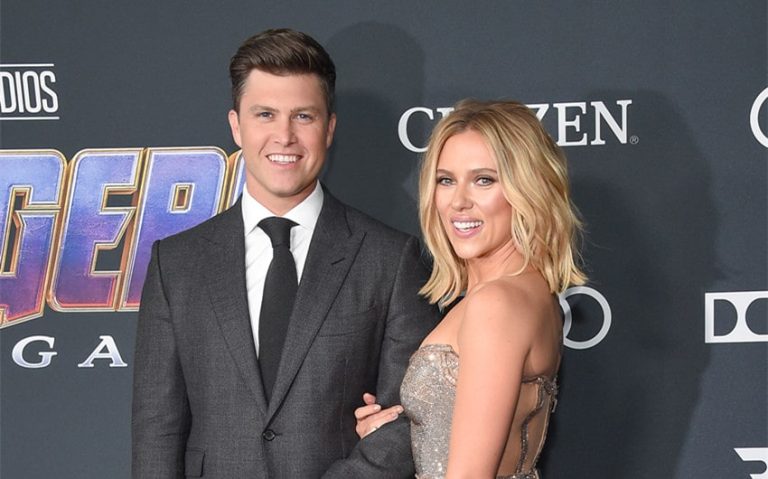

Image source: pagesix.com

Josh Conner is a seasoned finance professional with extensive experience in investment banking and private equity. Although he has recently gained public attention due to his engagement to Christine Baumgartner, he has built a strong reputation in the financial sector long before stepping into the spotlight.

Conner’s career began in the high-stakes world of investment banking, where he held key positions at major financial institutions. He has worked at firms like Morgan Stanley and Barclays, focusing on corporate finance, mergers and acquisitions, and strategic investments. His expertise in navigating complex financial transactions has made him a valuable asset in the industry.

Beyond banking, Conner is also an entrepreneur, having founded Connor Capital SB, an investment firm specializing in strategic investments across various industries. His leadership and financial acumen have earned him positions on multiple corporate boards, further expanding his influence in the business world. With a career rooted in high-level finance, he has solidified his place as a respected figure in the investment space.

Estimated Net Worth

Determining Josh Connor’s exact net worth is challenging due to varying reports and the private nature of his financial details. Estimates range significantly, with some sources suggesting approximately $828,671 (Celebs Worlds), while others propose figures up to $250 million (Net Worth Realm). This wide disparity likely stems from differences in reported assets, investments, and potential liabilities.

1. Investment Banking Salaries and Bonuses

Connor’s career began with significant roles in major financial institutions:

-

Morgan Stanley (1996–2011): Serving as Co-Head of the Transportation & Infrastructure Investment Banking Group, Connor was instrumental in positioning the firm as a leader in global advisory and capital markets within the transportation sector. Professionals in such senior roles typically receive substantial compensation, including base salaries and performance-based bonuses.

-

Barclays (2011–2015): As Global Head of Transportation Banking and later Co-Head of the Industrials Banking Group, Connor’s leadership contributed to the firm’s prominence in the industry. These executive positions are associated with high remuneration packages, reflecting the responsibilities and impact of the roles.

2. Private Equity and Investments

Beyond traditional banking, Connor has ventured into private equity and strategic investments:

-

Connor Capital SB, LLC (Founded in 2015): As the founding partner, Connor focuses on equity investments in transportation and related sectors. The firm’s portfolio includes significant investments in companies like Watco Holdings, a transportation service company, and Loadsmart, a digital freight brokerage leader. Returns from these investments contribute to his income, with successful ventures potentially yielding substantial profits.

-

Oaktree Capital Management (Since 2017): In his role as Managing Director and Co-Portfolio Manager of Infrastructure Investing, Connor oversees multi-billion-dollar investments. His compensation likely includes a combination of salary, performance bonuses, and profit-sharing, aligning with industry standards for managing large investment portfolios.

3. Board Memberships and Advisory Roles

Connor’s expertise has led to several board positions, providing additional income and influence:

-

Frontier Airlines (Since 2015): Serving as a board member, he contributes to strategic decisions impacting the airline’s operations and growth. Board members typically receive compensation through retainers, meeting fees, and stock options.

-

Copa Holdings (Since 2016): As an independent non-executive director, Connor plays a role in overseeing the company’s governance and financial performance. This position includes responsibilities on committees such as the Audit Committee, where he serves as chairman. Compensation for such roles often comprises fees and equity grants.

-

Watco Companies (Since 2018): His directorship at this transportation service company involves guiding corporate strategy and expansion efforts. Directors in such firms are compensated for their expertise and oversight, contributing to their overall income.

4. Entrepreneurial Ventures and Other Investments

Connor’s entrepreneurial spirit has led him to establish and invest in various ventures:

-

Duration Capital Partners LLC (Founded in 2024): As Co-Chief Executive Officer and Co-Portfolio Manager, he leads the firm’s investment strategies, focusing on infrastructure and related sectors. Success in these investments can result in significant financial returns, enhancing his net worth.

-

Early Investments in Technology: Connor’s investment portfolio includes early stakes in companies like Uber (2015) and REEF Technologies (2020), reflecting his interest in innovative and disruptive technologies. These investments have the potential for high returns, contributing to his wealth.

Featured Image Source: people.com